An improvement in disenrollment rate of up to 30%

PX's unique way to improve rapid disenrollment.

Click here to hear Industry Leaders from Carida & Clearview speak on how they counter Disenrollment.

Our clients are either insurers, agencies, or FMOs. Their challenge in AEP 2022 was to identify policyholders at risk of disenrolling their plan within 3 months. The goal was to improve rapid disenrollment rates and decrease the cost per acquisition (we calculate the CPA for policyholders that stay at least 3 months in their plan).

We are tackling a critical use case in the Medicare industry today by focusing on the value of retention and long-term growth of our clients. In Medicare terms, rapid disenrollment is when a policyholder, whom you helped enroll into a new plan, disenrolls from their new plan within three months of their enrollment, or before their enrollment is final. When a customer is considered a rapid disenrollment, the carrier will recover all of the commission that was involved with that sale. Further, a high rapid disenrollment rate deters your reputation with both carriers as CMS, since it can be an indicator of issues in the enrollment process.

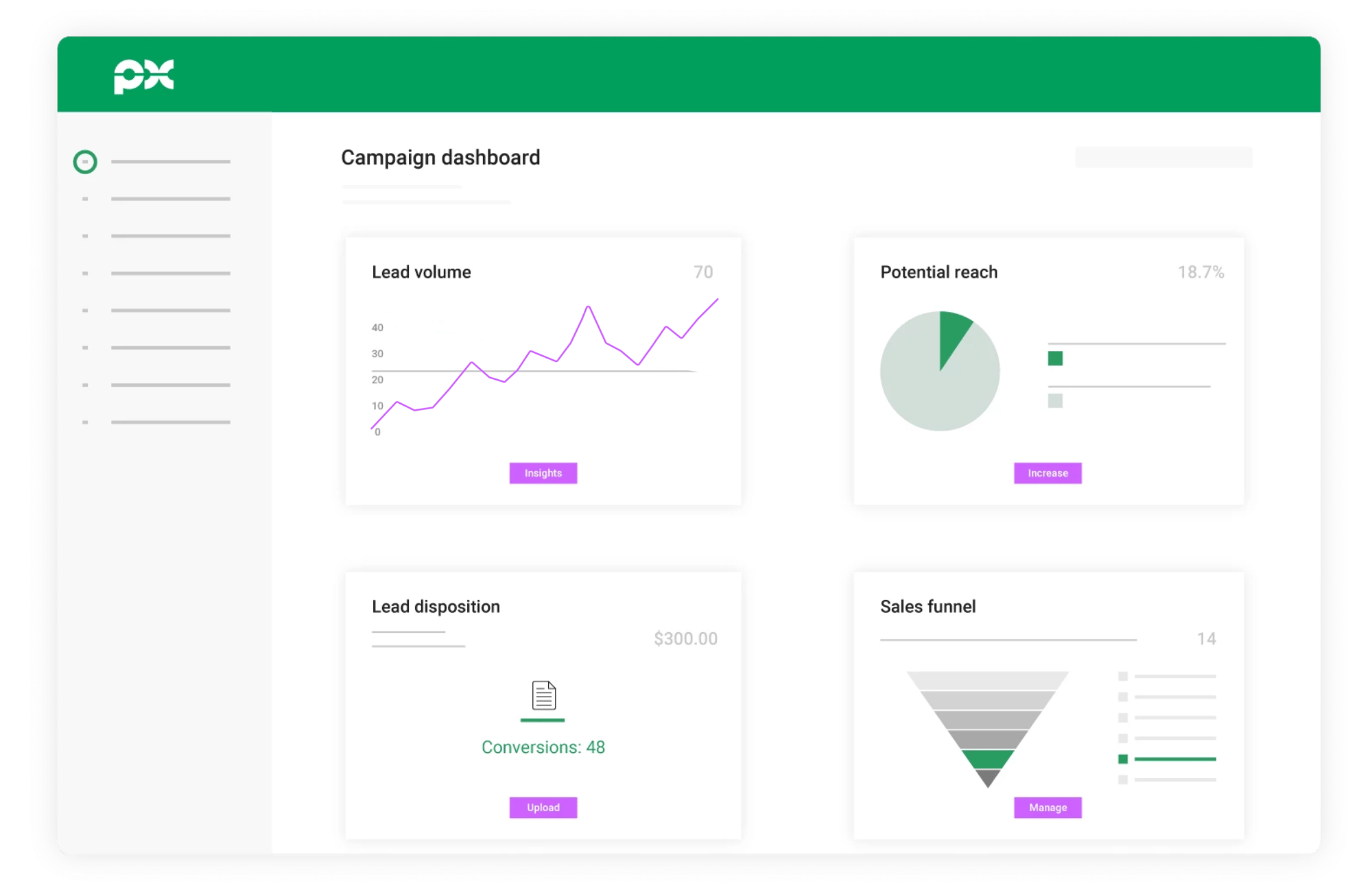

PX's Solution

Following the shopping behavior of new placements in the first three months.

To identify customers at risk of disenrolling within 3 months, we have been matching the 20M+ unique prospects going through the PX Marketplace, coming from 100+ CMS-approved publishers’ hosted webpages, forms, or call centres, with the client’s new placements. A match means that one of their new policyholders is shopping around again for a new Medicare plan and is therefore at risk of rapid disenrollment. These customers at risk often either have a question about their new policy or are not happy with it. To keep them from disenrolling their plan they need to be reached out to at the right moment.

It works as follows:

-1.png?width=3000&height=1500&name=Untitled%20design%20(2)-1.png)

Use case

It's AEP and John Smith is looking for a Medicare Advantage plan. To find one, he fills out a form requesting a quote on a publisher's website. PX's client bids on him dynamically and converts him into a policyholder.

From that moment PX will actively monitor John Smith by matching his data with the 20 million leads going through our marketplace.

2 months later, during OEP, John Smith fills out a form again on a different publisher's website because he is not sure he chose the right policy during AEP.

PX now immediately notifies the client that John Smith is shopping around again and routes this lead exclusively to them. The client reaches out to John Smith to keep him in their books.

Key Results

Last AEP and OEP, we matched tens of thousands of leads with our clients’ new policies, which meant that we were able to identify their new policyholders while they were shopping around again. Routing these leads to the retention team of our clients resulted in an improvement of the placement and rapid disenrollment rate of up to 30%.

This year we will have an even higher volume of unique prospects going through the marketplace. We enlarged our market coverage by connecting more CMS-approved publishers. This will lead to a higher match rate. The higher the match rate, the more at-risk customers you can identify and retain.